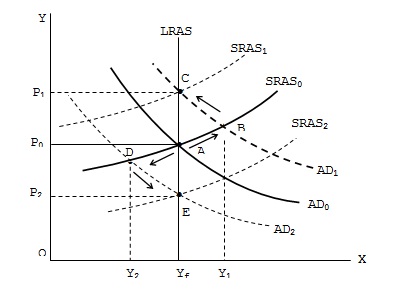

A positive demand shock may be caused by an autonomous increase in investment that causes an rightward shift in the AD curve. As we see in fig, to begin with, the economy is in the long-run equilibrium position at GDP level Yf (which is its potential GDP level) with the demand curve AD0 and long-run supply curve LRAS intersecting at point A. Thus, Yf is the full employment equilibrium level of GDP and P0 is the equilibrium price level.

Now, a positive demand shock raises AD0 curve to AD1. This curve intersecting the short-run supply curve SRAS0 at B that gives Y1 as the new equilibrium level of GDP since Y1 > Yf this opens up an inflationary gap due to which input prices, wages, etc., rise and causes leftward shift in the SRAS0 curve to SRAS1. The curve AD1 intersects SRAS1 as well as LRAS at C, which again establishes full employment equilibrium level at Yf (or potential GDP level), but price level goes up to P1.

A suitable monetary policy measure in this case, is to offset the positive demand shock (caused by increase in investment) by decrease in investment and reverting AD1 back to the position to AD0. This can be done by raising the interest rate and decrease in money supply. Increase in interest rate would reduce investment demand, lower investment expenditure, reduce aggregate expenditure and bring down aggregate demand. The AD1 curve will thus revert to its old position of AD0 thus eliminating inflationary gap and restoring Yf level of GDP.

The only danger is this policy prescription is that, it may sometimes take too long to implement policy measure such as raising the interest rate to the appropriate level. Thus, for example, if interest rate is raised only after a time lag when due to working of automatic stabilizers, the economy was already approaching any point between A and C on the LRAS curve (i.e., it was nearing the potential GDP level), then any reduction in investment due to increased interest rate will cause aggregate demand to fall and cause a downward shift in AD curve. This will reduce GDP level to below Yf and open up recessionary gap.

SUBMIT ASSIGNMENT NOW!