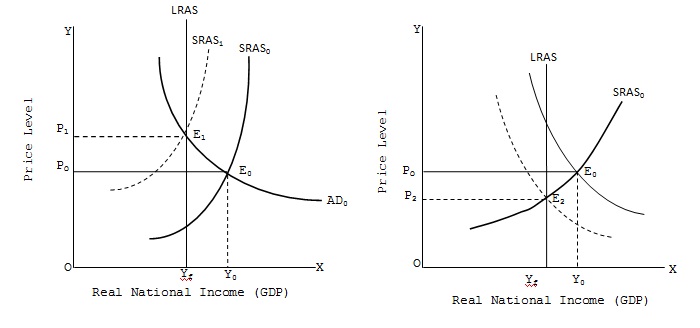

when the aggregate demand and aggregate supply curve intersect at a point that gives equilibrium GDP level above the economy’s potential GDP, this opens up the Inflationary gap. Such a situation is shown where equilibrium income level Y0 is greater than the potential GDP level Y2 thus opening up the inflationary gap Yf - Y0. The automatic stabilizers would increase wages and cause upward (leftward) shift in the SRAS0 curve to the new position SRAS1. The inflationary gap will thus be closed by reduction in GDP to Yf level and increase in price to P1 level. Again this automatic adjustment mechanism may be too slow and prolonged.

The alternative to this is the fiscal policy that causes a reduction in aggregate demand by increasing taxes and reducing government spending. With this the AD curve will shift downwards (leftwards) from AD0 to AD1 as shown. The GDP level will fall from Y0 to Yf and price level will decline from P0 to P2, as the equilibrium position moves down from E0 to E2 along the SRAS0 curve. The advantage of this policy is that it avoids the inflationary increase in price level from P0 to P1 as is the case with automatic adjustment method as shown. But the danger is that if along with a cut in public sector spending, the private sector spending also continues to fall, the AD curve may be pushed down even below the AD1 that would cause recessionary gap to open up, thus again rendering instability to the economy.

SUBMIT ASSIGNMENT NOW!